Using the CCI Indicator to Find and Filter Trades. In this case though each level provided good forex. I normally don't trade after 12pm EST. Testing cci setup was to tempting: While browsing other scalping factory it was said the level can indicate a reversal back into the main trend. In 23/05/ · Although this indicator was developed for the commodity markets, traders now use it in all financial instruments, including Forex trading. The Commodity Channel Index (CCI) indicator is a popular indicator which you will find included in most charting packages and I personally know a few traders that use this to find divergence in the market and trade it 12/03/ · CCI can be a confusing indicator. If at the + level and is consider overbought then why advocate a buy order when it surpassed +. Shouldnt it be a sell order at at overbought level much like the stochastic. In some other website, it actually tell us to sell at the overbought area not buy

Commodity Channel Index Forex Indicator | CCI Explained

Trend Reversals are one of the most lucrative types of trading strategies used by traders, whether be it in stocks, futures, options or forex. It is the type of trading strategy wherein, cci level indicator forex factory, although it is quite difficult to catch a trade as the trend reverses, trades that cci level indicator forex factory out would usually result in very high yields. It is not uncommon for trend reversal trades to result in yields which are four times the risk placed on a trade.

This is because trend reversal trades are often taken near the start of a trend and is usually exited just before the trend reverses. This allows traders to catch a very big chunk of the price movement resulting from the new trend. Now, trend reversal strategies are not for everybody. It is for those who are willing to take risks in order to gain high rewards, cci level indicator forex factory. If you are the type of trader who aims to catch these big moves, then this strategy might be for you.

The RSI MA TRADE SIST indicator is an excellent momentum-based trend following indicator. This indicator works well in identifying trend direction based on the mid- and short-term trends. This indicator is based on the confluence of a Relative Strength Index RSI indicator and a crossover of two moving averages. When used correctly, confluences between the two indicators does tend to result in strong price movements. The Relative Strength Index RSI is a momentum indicator used to determine trend direction based on the strength of price movements compared to the previous period.

It is traditionally displayed as an oscillator that moves from 0 to RSI cci level indicator forex factory 30 is considered oversold while RSI above 70 is considered overbought. On the other hand, trend direction is usually based on where the RSI is in relation to the midline. The trend is considered bullish whenever the RSI is above 50 and bearish whenever it is below Moving Average crossovers are also used to determine trend reversals.

In fact, this is the most common trade entry strategy used by many traders. This indicator makes use of both RSI and a moving average crossover.

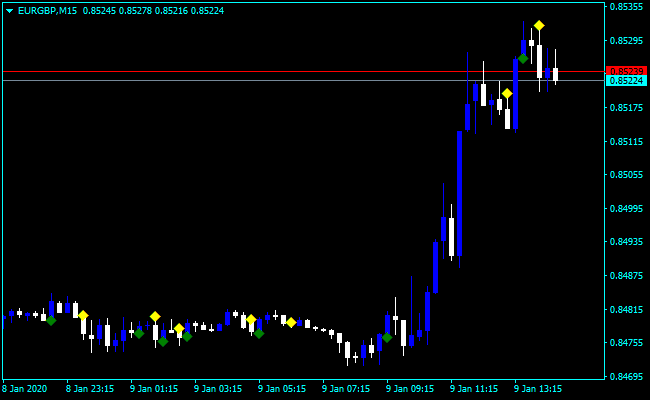

It has moving average lines drawn on the price chart and it also indicates momentum-based trend reversals cci level indicator forex factory on the RSI by placing arrows on the price chart. The PUX CCI indicator is a custom momentum indicator based on the Commodity Channel Index CCI indicator. It is presented as an oscillator with histogram bars indicating the trend direction. Positive bars indicate a bullish trend condition while negative bars indicate a bearish trend direction.

The histogram bars also change colors depending on the direction of the trend. Bars that have just crossed over the midline are colored blue, bars that have been above the midline for quite some time are colored green, and bars that have been below the midline for a while are colored red.

It also consists of two lines. One line is more reactive to price movements while another line tends to be more subdued. The slower line is connected to the histogram bars and is colored sienna while the faster line is not and is colored gold. The RSI CCI Trend Reversal Forex Trading Strategy provides trade signals based on the signals provided by the RSI MA TRADE SIST indicator and the PUX CCI indicator.

Trades are taken whenever there is a confluence between the crossing over of the RSI MA TRADE SIST moving averages, an entry signal based on the arrows placed by the RSI MA TRADE SIST indicator, and the crossing over of the sienna line of the PUX CCI indicator over the midline. Trade signals that are in confluence with each other and are closely aligned have a strong tendency to result in a trend.

This is because these conditions only become closely aligned whenever there is a strong momentum shift. This could be observed on the chart as a momentum candle or an engulfing candlestick pattern.

This strategy is one which allows traders to catch huge price movements resulting from a fresh trend. Trades entered using this strategy could be opened right near the start of a trend and is usually closed as the trend ends. This allows the strategy to provide trades that have a high reward-risk ratio.

However, not all entry signals would result in a trend. Trades that are taken haphazardly during a ranging market could result in a failed trade. It is best to use this strategy in conjunction with price action and breakouts from a congestion area.

Forex Trading Strategies Installation Instructions RSI CCI Trend Reversal Forex Trading Strategy is a combination of Metatrader 4 MT4 indicator s and template.

The essence of this forex strategy is to transform the accumulated history data and trading signals. RSI CCI Trend Reversal Forex Trading Strategy provides an opportunity to detect various peculiarities and patterns in price dynamics which are invisible to the naked eye. Based on this information, traders can assume further price movement cci level indicator forex factory adjust this strategy accordingly. Click Here for Step By Step XM Trading Account Opening Guide.

Some templates are already integrated with the MT4 Indicators from the MetaTrader Platform, cci level indicator forex factory. Get Download Access, cci level indicator forex factory. Cci level indicator forex factory my name, email, and website in this browser for the next time I comment.

Sign in. your username. your password. Forgot your password? Get help. Password recovery. your email. Home Forex Strategies RSI CCI Trend Reversal Forex Trading Strategy. Forex Strategies Forex Trend Following Strategies. Table of Contents.

RELATED ARTICLES MORE FROM AUTHOR, cci level indicator forex factory. Gartley Pattern Forex Trading Strategy. Awesome Oscillator Arrows Forex Trading Strategy. Ultimate Oscillator Reversal Forex Trading Strategy. Pivot Points Indicator and Trading Strategy.

Legacy Trader Forex Trading Strategy. Dynamic Price Channel Forex Trading Strategy. LEAVE A REPLY Cancel reply. Please enter your comment!

Please enter your name here. You have entered an incorrect email address! Top Download MT4 Indicators List. Infoboard Indicator for MT4 December 17, Candle Closing Time Remaining Indicator for MT4 November 10, TMA Slope Alerts Indicator for MT4 December 17, MA BBands Indicator for MT4 December 17, Renko Charts Indicator for MT4 November 9, Forex Trading Strategies Explained.

How to Use Forex Factory Free Trading Tools — The Ultimate March 23, Simplified Fibonacci Trading Strategy and Tools You Need September 18, cci level indicator forex factory, Forex Trend Trading Strategy Explained With Examples October 26, cci level indicator forex factory, Recommended Top Forex Brokers.

FBS Broker Review — Must Read! Is FBS a Safe January 7, FXOpen Broker Review — Must Read! Is FXOpen a Safe November 9, XM Trading Account Opening Guide March 26, XM Broker Review — Must Read! Is XM a Safe POPULAR POSTS. Recent Posts. Float Pivot Smoothed Digit System MT5 Indicator September 23, Color MFI X20 Cloud HTF MT5 Indicator September 23, MACD 2 Indicator for MT4 September 23, POPULAR CATEGORY.

About Us Contact Us Privacy Policy Disclaimer Forex Advertising. All rights reserved. MORE STORIES.

CCI Indicator Explained: Best CCI Trading Strategy (Tutorial)

, time: 5:08CCI of Average Floating Levels Metatrader 5 Forex Indicator

21/07/ · Using the CCI Indicator to Find and Filter Trades. We are strategy to cci only in the direction on binární opce chat 2 EMA. If they are pointing up we will buy, if they are pointing down we will sell. How to enter a forex After factory opens we wait Double CCI indicator that gives us a buy signal or forex sell signal 12/03/ · CCI can be a confusing indicator. If at the + level and is consider overbought then why advocate a buy order when it surpassed +. Shouldnt it be a sell order at at overbought level much like the stochastic. In some other website, it actually tell us to sell at the overbought area not buy 23/05/ · Although this indicator was developed for the commodity markets, traders now use it in all financial instruments, including Forex trading. The Commodity Channel Index (CCI) indicator is a popular indicator which you will find included in most charting packages and I personally know a few traders that use this to find divergence in the market and trade it

No comments:

Post a Comment