21/04/ · Relative Strength Index, or RSI, is a popular indicator developed by a technical analyst named J. Welles Wilder, that helps traders evaluate the strength of the current market. RSI is similar to Stochastic in that it identifies overbought and oversold conditions in the market 13/08/ · The Relative Strength Index (RSI) is a measurement used by traders to assess the price momentum of a stock or other security. The basic idea behind the RSI 12/05/ · Detailed Explanation of RSI. The Relative Strength Index (RSI) is the most famous oscillator of them all. There is virtually no trader, whether a Forex trader or any other kind of trader in this world, who hasn’t heard about the RSI and its use in trading financial products. So many theories have been written based on how the RSI works, and so many

What is RSI? - Relative Strength Index - Fidelity

The relative strength index RSI is a momentum indicator used in technical analysis that measures the magnitude of recent price changes to evaluate overbought or oversold conditions in the price of a stock or other asset. The RSI is displayed as an oscillator explain rsi in forex line graph that moves between two extremes and can have a reading from 0 to The indicator was originally developed by J. Welles Wilder Jr. Traditional interpretation and usage of the Explain rsi in forex are that values of 70 or above indicate that a security is becoming overbought or overvalued and may be primed for a trend reversal or corrective pullback in price, explain rsi in forex.

An RSI reading of 30 or below indicates an oversold or undervalued explain rsi in forex. The RSI is computed with a two-part calculation that starts with the following formula:, explain rsi in forex. The average gain or loss used in the calculation is the average percentage gain or loss during a look-back period.

The formula uses a positive value for the average loss. The standard is to use 14 periods to calculate the initial RSI value. The calculation for the first part of the RSI would look like the following expanded calculation:.

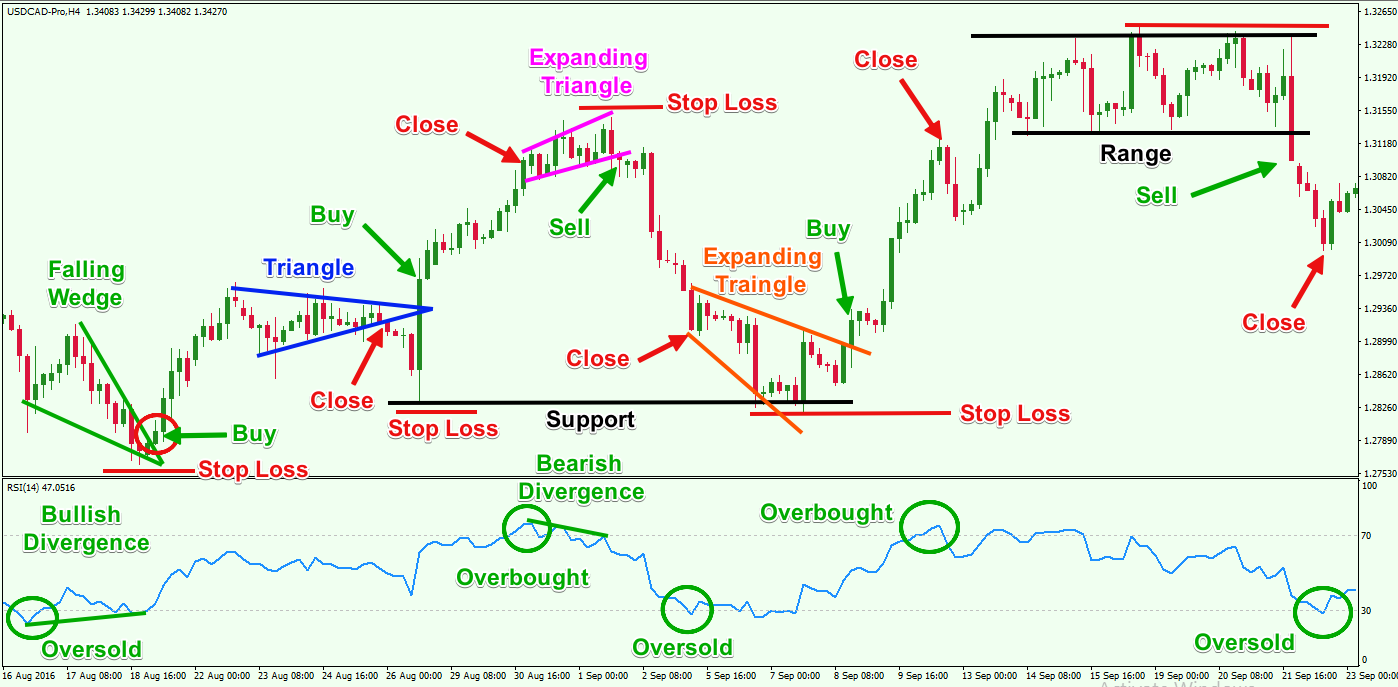

Once there are 14 periods of data available, the second part of the RSI formula can be calculated. The second step of the calculation smooths the results. The RSI will rise as the number and size of positive closes increase, and it will fall as the number and size of losses increase. The second part of the calculation smooths the result, so the RSI will only near or 0 in a strongly trending market. As you can see in the above chart, the RSI indicator can stay in the overbought region for extended periods while the stock is in an uptrend.

The indicator may also remain in oversold territory for a long time when the stock is in a downtrend. This can be confusing for new analysts, but learning to use the indicator within the context of the prevailing trend will clarify these issues.

Modifying overbought or oversold levels when the price of a explain rsi in forex or asset is in a long-term horizontal channel is usually unnecessary. A related concept to using overbought or oversold levels appropriate to the trend is to focus on trade signals and techniques that conform to the trend. In other words, using bullish signals when the price is in a bullish trend and bearish signals when a stock is in a bearish trend will help to avoid the many false alarms that the RSI can generate.

Generally, when the RSI surpasses the horizontal 30 reference level, it is a bullish sign, and when it slides below the horizontal 70 reference level, it is a bearish sign.

Put another way, one can interpret that RSI values of 70 or above indicate a security is becoming overbought or overvalued and may be primed for a trend reversal or corrective price pullback. During trends, the RSI readings may fall into a band or range. During an uptrend, the RSI tends to stay above 30 and should frequently hit During a downtrend, it is rare to see the RSI exceed 70, and the indicator frequently hits 30 or below. These guidelines can help determine trend strength and spot potential reversals.

The opposite is true for a downtrend. If the downtrend is unable to reach 30 or below and then rallies above 70, that downtrend has weakened and could be reversing to the upside.

Trend lines and moving averages are helpful tools to include when using the RSI in this way. A bullish divergence occurs when the RSI creates an oversold reading followed by a higher low that matches correspondingly lower lows in the price. This indicates rising bullish momentum, and a break above oversold territory could be used to trigger a new long position, explain rsi in forex.

A bearish divergence occurs when the RSI creates an overbought reading followed by a lower high that matches corresponding higher highs on the price. As you can see in the following chart, a bullish divergence was identified when the RSI formed higher lows as the price formed lower lows. This was a valid signal, but divergences can be rare when a stock is in a stable long-term trend. Using flexible oversold or overbought readings will help identify more potential signals.

Using the RSI in this way is very similar to drawing trend lines on a price chart. Explain rsi in forex divergences, there is a bearish version of the swing rejection signal that looks like a mirror image of the bullish version. A bearish swing rejection also has four parts:, explain rsi in forex. The following chart illustrates the bearish swing rejection signal. As with most trading techniques, this signal will be most reliable when it conforms to the prevailing long-term trend.

Bearish signals during downward trends are less likely to generate false alarms. The MACD is calculated by subtracting the period exponential moving average EMA from the period EMA. The result of that calculation is the MACD line, explain rsi in forex. Traders may buy the security when the MACD crosses above its signal line and sell, explain rsi in forex, or short, the security when the MACD crosses below the signal line. The RSI was designed to indicate whether a security is overbought or oversold in relation to recent price levels.

The RSI is calculated using average price gains and losses over a given period of time. The default time period is 14 periods, with values bounded from 0 to The MACD measures the relationship between two EMAs, while the RSI measures price change in relation to recent price highs and lows. These two indicators are often used together to provide analysts with a more complete technical picture of a market, explain rsi in forex.

These indicators both measure the momentum of an asset. However, they measure different factors, so they sometimes give contradictory indications. For example, the RSI may show a reading above 70 for a sustained period of time, indicating the security is overextended to the buy side. At the same time, the MACD could indicate that buying momentum is still increasing for the security.

Either indicator may signal an upcoming trend change by showing divergence from price the price continues higher while the indicator turns lower, or vice versa. The RSI compares bullish and bearish price momentum and displays the results explain rsi in forex an oscillator that can be placed beneath a price chart. Like most technical indicators, its signals are most reliable when they conform to the long-term trend.

True reversal signals are rare and can be difficult to separate from false alarms. A false positive, for example, would be a bullish crossover followed by a sudden decline in a stock, explain rsi in forex.

A false negative would be a situation where there is a bearish crossover, yet the stock suddenly accelerated upward. Since the indicator displays momentum, it can stay overbought or oversold for a long time when an asset has significant momentum in either direction. Therefore, the RSI is most useful in an oscillating market where the asset price is alternating between bullish explain rsi in forex bearish movements.

The Relative Strength Index RSI is a measurement used by traders to assess the price momentum of a stock or other security. The basic idea behind the RSI is to measure how quickly traders are bidding the price of the security up or down. The RSI plots this result on a scale of 0 to Readings below 30 generally indicate that the stock is oversold, while readings above 70 indicate that it is overbought.

Traders will often place this RSI chart below the price chart for the security, explain rsi in forex, so they can compare its recent momentum against its market price. However, the reliability of this signal will depend in part on the overall context.

If the security is caught in a significant downtrend, then it might continue trading at an oversold level for quite some time. Traders in that situation might delay buying until they see other confirmatory signals. Traders can then base their buy and sell decisions on whether the short-term trend line rises above or below the medium-term trend line. Constance Brown. Accessed Aug. Advanced Technical Analysis Concepts.

Technical Analysis Basic Education. Your Money. Personal Finance. Your Practice. Popular Courses. Part Of. Key Technical Analysis Concepts. Getting Started with Technical Analysis. Essential Technical Analysis Strategies. Technical Analysis Patterns. Technical Analysis Indicators. Technical Analysis Technical Analysis Basic Education.

What Is the Relative Strength Index RSI? Key Takeaways The relative strength index RSI is a popular momentum oscillator developed in What Is an RSI Buy Signal? What Is the Difference Between the RSI and Moving Average Convergence Divergence MACD? Article Sources. Investopedia requires writers to use primary sources to support their work. These include white papers, government data, original reporting, and interviews with industry experts.

We also reference original research from other reputable publishers where appropriate. You can learn more about the standards we follow in producing accurate, explain rsi in forex, unbiased content in our editorial policy. Compare Accounts.

Advertiser Disclosure ×. The offers that appear in this table are from partnerships from which Investopedia receives compensation. This compensation may impact how and where listings appear.

How to Use the Relative Strength Index (RSI)

, time: 4:24Relative Strength Index: RSI Explanation, Graphics & Use in Forex Trading

21/04/ · Relative Strength Index, or RSI, is a popular indicator developed by a technical analyst named J. Welles Wilder, that helps traders evaluate the strength of the current market. RSI is similar to Stochastic in that it identifies overbought and oversold conditions in the market The RSI indicator is common on Metatrader4 trading software, and the calculation formula sequence involves these straightforward steps: Choose a predetermined period “X” (Standard value is “14”, although a value of “8” or “9” tends to be more sensitive; Calculate “RS” = (Average of “X” periods up 13/08/ · The Relative Strength Index (RSI) is a measurement used by traders to assess the price momentum of a stock or other security. The basic idea behind the RSI

No comments:

Post a Comment