Bearish Doji reversal candlesticks pattern. A bearish Doji reversal candlestick pattern is when a bullish trend is shifted into a bearish trend after a Doji candle (Doji candle is a candle when a market’s open price and close price are almost the same).It is the tendency for candlesticks that are classified as being doji to be regarded as being neutral 02/03/ · Shooting star candlesticks. Hammer candlestick patterns. Doji candles. This guide is going to cover day candlestick reversal patterns using candlestick charts and not chart patterns such as the butterfly pattern or the cup and handle pattern. For traders looking for the best Forex trading indicator, you are looking at it – price movement Reversal candlestick patterns are an excellent way to enter or exit a trade. There are a quite a few candlestick patterns you can use and the best way to find them is to use a candlestick pattern indicator which you can download below. How The Forex Candlestick Pattern Indicator Works

Candlestick Reversal Patterns | Top 5 for Forex Trading

Successful traders trade in line with the trend. They study the charts and master the art of identifying patterns in them. It helps to derive valuable information from the forex reversal patterns and continuation patterns hidden between the candles. The identification of patterns and adapting to the market movements provide successful trade results.

Patterns are unique forms or shapes which occur repeatedly and produce reliable results whenever they occur. Patterns provide clues of the impending next move or a glimpse of the future price movement most of the time. Since these patterns form repeatedly, a careful study of them produces a great understanding of the price movements. This improves the trading results of the forex trader significantly. Patterns form an essential aspect of technical analysis and provide the basis for many technical tools and indicators.

Forex patterns are classified forex candle stick reversal patterns forex continuation patterns and forex reversal patterns. The most importantly searched and followed being the forex reversal patterns, forex candle stick reversal patterns. Forex reversal patterns provide the trader with the best exit point of a current trend. Similarly, they offer an excellent trading opportunity to enter the markets at the beginning of a new direction.

On the other hand, continuation patterns provide a profitable opportunity to add more positions and scale up to maximize profits. Japanese rice traders used candlestick charts. They discovered that the emotions of the traders widely influenced the supply and demand of a trading instrument. Thus the emotions were considered as an essential factor that influenced the price movements. Human emotions tend to be in patterns, and the chart proved it repeatedly. Candlestick patterns provide valuable clues to those emotions and their influence on prices.

The candlestick charting was introduced to the West by Steve Nison. Price tends to reverse their current direction upon the formation of these candlestick reversal patterns.

As these patterns predict a reversal, their presence or absence is very closely monitored by forex traders. Many traders use the reversal patterns extensively to manage their current trades and plan new ones. Candlestick reversal patterns provide the best possible entry points and a very reasonable stop loss.

But they do not give a take profit point as the purpose of these patterns is to identify the entry points. Most forex traders use forex candle stick reversal patterns reasonable risk and reward ratio to calculate the take profit points or use other technical indicators and tools to determine the best take profit points. Forex candle stick reversal patterns tools have been programmed as forex reversal pattern indicator.

But its at the best interest of the trader to manually identify and understand them. The Hammer pattern is a frequently occurring forex candlestick reversal pattern. Traders easily identify it due to its shape of a long wick and a small body. The length of the wick usually is more than thrice the length of the body of the candle.

The next candle confirms the hammer pattern, forex candle stick reversal patterns. Hammers occur in a downtrend and signal a waning momentum of the sellers and their increasing strength.

During the downtrend, the long wick shows the sellers losing control to the buyers. A hammer formed in a flat market or during low volatile markets may not produce significant results. Most patterns formed during the US or London sessions provide the best results. Hanging man patterns are similar to the hammer pattern. But the Hanging man pattern is formed on the uptrend.

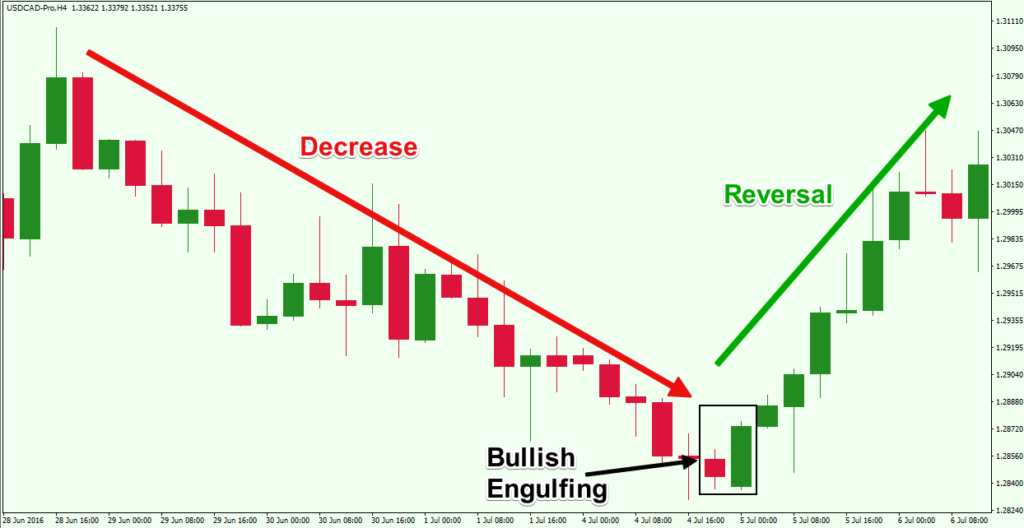

The hanging man candlestick predicts a reversal in the prices. The candle can be easily identified by the long wick and real short body. The next candle confirms the Hanging man. If the prices close lower in the next candle to the Hanging man, it signifies the sellers took control of the market and predicts a reversal. Bullish engulfing candles occur repeatedly and can be traded successfully, forex candle stick reversal patterns.

They provide more opportunities as they occur frequently. Bullish engulfing can happen in any time frame and can be successfully traded by scalpers and swing traders. The bullish engulfing candle engulfs the previous sell candle. The engulfing of the last candle in the opposite direction indicates the market sentiment to the trader.

The bears are in control in a downtrend, but this engulfing candle opens lower than the previous bear candle and closes higher, completely engulfing it. This provides the trader information that the buyers now have control over the market and anticipates a price reversal to the upside direction.

Buyers can enter the market at the close of the engulfing candle, with stops below the previous swing low. The bearish engulfing pattern is opposite to the bullish engulfing candlestick pattern, forex candle stick reversal patterns. In the above picture, the prices were on an uptrend.

The uptrend witness a stall in the movement followed by the formation of a bearish engulfing candle. The engulfing candle opened higher than the previous bull candle and closed below it, engulfing it. Traders can visually see the engulfing and enter the markets with a sell position with stops above the last swing high. This pattern is also frequent, and the formation indicates a price reversal.

In an uptrend, the Harami candle forms as a bear candle. The harami candle opens lower than the previous up candle and also closes higher than it. The candle can be easily visually identified as it will be shorter than the previous candle of harami candlestick and stays within the high and low of the forex candle stick reversal patterns candle.

The harami candle and the previous candle are always in opposite directions. In a bearish harami pattern, the previous candle should be bullish.

If the Harami candle is a Doji, then the pattern is called as Bearish Harami Doji Pattern. The Bullish Harami pattern is the opposite of the bearish Harami pattern. The pattern occurs during a downtrend and predicts a reversal in the prices to the upwards. The bullish Harami candle opens higher than the previous candle and closes lower than it. If the Harami candle is a Doji, the pattern is called a Bullish Harami Doji pattern.

The Three White Soldiers is a bullish candlestick reversal pattern and provides the best opportunity to buy the trading instrument. The pattern is identified by the formation of three bullish candles in a row. At the close of the third bullish candle and forex candle stick reversal patterns loss, the entry point is at the low of the first of the three candles, forex candle stick reversal patterns. The Three Black Crow pattern is the opposite of the Three White Soldiers pattern, forex candle stick reversal patterns.

The pattern is visible by the formation of three bearish candles continuously in a row. The formation of three candles confirms that the sellers have indeed taken over the buyers, forex candle stick reversal patterns. Since the sellers have the control, the trader enters the market in a sell direction, anticipating prices to continue lower.

The Morning star Doji pattern is a bullish reversal pattern. The pattern consists of a DOJI forex candle stick reversal patterns. A Doji candle has the same opening price and closing price, forex candle stick reversal patterns. The Doji reflects indecision in the market sentiment. A Doji candle may form during indecision periods and low volatility, particularly during the weekends or at the closing hours or the opening hours. There will be less liquidity. The Doji formed during these times may not provide the best trading results.

It is always better to understand the formation in context during trending markets, as the formation will signify a real moment of indecision while prices are trending. The Doji candle can be formed in different types and shapes as Long Legged Doji, Gravestone Doji, Dragonfly Doji. An Evening Star Doji Pattern is the opposite of the Morning Star Doji Pattern.

It occurs in an uptrend and signifies the reversal of the trend. The presence of Doji indicates indecision in the market sentiment; the following candle validates the Doji. The traders can use other technical tools at their discretion to confirm the reversal and trade accordingly, forex candle stick reversal patterns.

The morning star reversal pattern is similar to the Morning Star Doji Pattern. The Morning star pattern has a regular candle instead of a Doji. The reversal candle is smaller in size and is in the opposite color.

The reversal candle in the downtrend is an up candle. The following candles further confirm the formation of a trend reversal. This candlestick reversal pattern is opposite to the Morning Star pattern and is similar to the Evening Star Doji pattern. The pattern can be traded using he same entry and stop loss conditions. Candlestick patterns reflect the underlying market sentiment, but they also fail in some instances.

Forex candle stick reversal patterns candlestick patterns must be confirmed only if relevant price action follows the pattern for a trader to act upon. Some of the patterns need to have more than one candle for the pattern to be confirmed.

New traders may not have the patience to wait for the patterns to complete and may enter the markets prematurely.

Candlestick pattern is a part of technical analysis and should be treated that way. They should be included with forex candle stick reversal patterns forms of technical analysis to derive the conclusion.

TOP 3 REVERSAL PATTERNS - Powerful \u0026 Simple Price Action

, time: 17:15Top 5 Forex Reversal Patterns To Enter Huge Trades - PriceActionNinja

Top Candlestick Reversal Patterns. We will start with four of the most popular and effective candlestick reversal patterns that every trader should know. Doji Candlestick Pattern. The Doji candle is one of the most popular candlestick reversal patterns and it’s structure is very easy to Estimated Reading Time: 10 mins 15/10/ · Here is a list of the seven most popular reversal candlestick patterns used in technical analysis to determine a high probability area on a chart for a reversal of a current trend. These patterns show a shifting in power from buyers to sellers or sellers to buyers through the price action of the candle being unable to make higher highs or lower Candlestick reversal patterns are one of the most commonly used technical trading signals in futures and forex trading. While they do not represent a magic bullet to becoming a millionaire trader, over time candlestick reversal indications have been found to be a reliable indicator of trend change

No comments:

Post a Comment