The Pin Bar Pattern (Reversal or Continuation) A pin bar pattern consists of one price bar, typically a candlestick price bar, which represents a sharp reversal and rejection of price. The pin bar reversal as it is sometimes called, is defined by a long tail, the tail is also referred to as a “shadow” or “wick”.Images 13/10/ · Continue to publish the materials according to the method of Forex trading called Price Action. Today’s topic is the pattern Inside Bar. Inside bar along with Pin-Bar, is a very powerful Price Action setup, if you apply it wisely. This setup is quite famous among the Forex traders and is one of the fundamental in the methodology of Price blogger.comted Reading Time: 7 mins 19/03/ · In this Forex trading lesson, I am going to share with you three of my favorite price action trading strategies; pin bars, inside bars and false. These trading setups are simple yet very powerful, and if you learn to trade them with discipline and patience you will have a very potent Forex trading edge

Pin Bar Reversal & Inside Bar Forex Trading Method » Learn To Trade The Market

Continue to publish the materials according to the method of Forex trading called Price Action, forex price action inside bar pin bar. Inside bar along with Pin-Baris a very powerful Price Action setup, if you apply it wisely. This setup is quite famous among the Forex traders and is one of the fundamental in the methodology of Price Action. It is most often referred to as continuation patterns the major trendalthough it can act as a reversal pattern. Overall, the Inside Bar is a figure for the trained traders because the beginners in Forex may have difficulties with his interpretation.

However, if you know how to use Inside Bar and what you should pay attention to, with the help of it, you can forex price action inside bar pin bar a pretty strong trend. Inside bar is a full-bodied candle followed by a candle of small size, that is entirely inside the range of the previous full-bodied candle:, forex price action inside bar pin bar.

Full-bodied first candle is called the maternal candle. This candle needs to be at least two times larger than the inner candle. If you see on the chart the full-bodied candle, behind which there is a candle inside its range, but it is large in size, then this combination is not proper Inside Bar:.

Why is it so? Because in this case, all logical sense of this setup is lost. Why do we take into account this phenomenon and why we can use it to trade? To do this we should answer another question. It means that the strength of the current movement lost meaning, as the next candle is small in size, and there is a temporary agreement in price between buyers and sellers.

We can say that it is a small truce before a new battle. During this forex price action inside bar pin bar, we can enter the market and follow the established trend. Or we can enter against the trend. As you can see, first a full-bodied candle comes, followed by a small candle. In this example, we had Inside Bar, which was countertrend.

It is interesting that it is not necessary that a maternal candle supported on the level with its base. If the Inside Bar is on the level and has support, then you have every reason to enter the market, forex price action inside bar pin bar. This example depending on the interpretation and your trading method of entry into the market, most likely, would bring a loss.

However, with a certain approach, it could give you profit. Maternal candle breaks the level, and then there is an Inside Bar, which is based on the level. And this is round 1. As we know, round price values are important levels of support and resistance. In this example, forex price action inside bar pin bar should pay attention to the fact that the low point of an inside bar is lower than the low point of the maternal candle.

Such an error is permissible. As this is a daily chart, forex price action inside bar pin bar, these 4 pips can be considered a small error. Remember, that technical analysis is an art, not an exact science. And small deviations are possible that is why this setup is still valid.

The fact is that you enter the market later, but you get more confidence in the selected direction of the price. The entrance on the breakout of the extreme point of the inside bar is earlier, but it is risky. You enter the market earlier, but if the price breaks through the outermost point of the inside bar and then move another side, then your stop loss, which could not happen, will trigger. As for me, I tend to work with the breakout of the maternal candle. Thus it is necessary to always look at the situation.

You need to estimate where inside bar is in relation to the maternal candle, how big the maternal candle was, where the level, symbolizing a footing, is now. All of this requires your experience in the Forex market. In any deal, we always set a stop loss. This is necessary in order to protect your account and not incur large losses. There are several options for setting a stop loss for this setup.

The first of them is a classic one. We set stop loss over the opposite side of a maternal candle:. This forex price action inside bar pin bar is more reasonable, as a crossing of the level would mean that we were wrong. It should be used when it is adequate. If the level is not very far from the entrance, then we can use this option. You might think that this stop loss is very easy to dislodge. Let it force us to repeatedly make mistakes but it will also periodically let us make profit trades, which will be several times more than our initial stop loss.

It can be a fixed take profit equal to pips on a daily chart. If you trade on the charts below, there will be the smaller number of pips. This option is ideal for those who want to be sure that the profit will be taken.

It will be not quite big, as it can be, but the probability of getting is high. If you use this approach with a small stop loss, it has the right to life. Also, we can use trailing stop to exit trades automatically. The price passes by 40 pips, and we transfer a trade to breakeven. That is, we move the stop loss to the level of the entry point. Next, we set a trailing stop or some distant target.

Even if the market will turn against us, we will not lose anything. The most common methods of getting profit for this setup is the next level, a fixed number of pips and a stop loss multiplied by N.

It depends on your forex price action inside bar pin bar and market situation. For beginners, I suggest using a fixed level. Set a certain number of pips, depending on currency pair and timeframe. But you should remember that this fixed number must be greater than the inside bar.

I am sure that you could read and hear it for many times but I still want to repeat that you should enter on the trend. This increases the chance of getting a profit in the transaction. If the maternal candle is disproportionately huge and exceeds inside bar 10 times, then most likely, there will be a significant pullback and you should not take such setup. If there was formed inside bar after a similar candle, then you should not enter the market.

The candle is too big and the probability of the rebound is too high. We try to skip big candles. Any setup consisting of one or two candles must be after some movement. If the candles are in a row and there is a setup, you should not get into it. It is better to skips than to risk unnecessarily. As we have seen above, inside bar means a temporary agreement in price between buyers and sellers. How can there be an agreement in price, if inside bar is big?

If it is rather big, so there is no agreement, and, most likely, there is a completely different situation in the market. So, we consider the entrance only in the direction of SELL. If the inside bar is bullish, we consider the entrance for BUY only. As we have seen earlier, inside bar is a temporary agreement between the sellers, but there is some advantage.

This is what inside bar shows. In my trading, I try to take the setups that match the color of inside bar. If the inside bar is bullish, we forex price action inside bar pin bar looking for the chance to BUY.

If inside bar is bearish, we are looking for an opportunity of an entrance to SELL. This filter will help to increase the overall profitability of trading on this setup. Remember that you may not to pay attention to the color of the inside bar. In any case, it will work, but the efficiency of the pattern will be slightly less.

Trade only during US and London session. Like other Price Action setups, Inside bar begins to work well from H1 timeframe and higher. If you trade within the day, then try to trade during London or US sessions. Because after we have found an area of agreement between buyers and sellers, we need any movement to take profits.

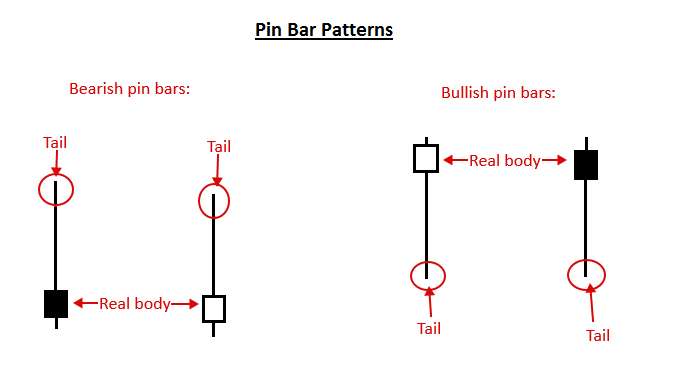

If the Inside bar formed a Doji pattern or a figure of Pin-bar, then in such cases I would not advise entering the market because the situation is unclear:.

The chart shows a bullish candle and followed inside bar. But this bar is a Pin-bar with a huge tail. Such a signal should be skipped. It is better to calm down and wait for further developments.

As you can see, nothing happens on the chart. Pay attention that the Inside bar takes half of the maternal candle, and in this case, I would not recommend entering the market. Even if we see a slight increase in the future, but next time it may turn against your positions.

The Inside bar has a very long tail.

Trading Price Action Using PIN BARS (Best Forex Candlestick Reversal Pattern)

, time: 10:03How to Trade the Inside Bar Pin Bar Combination

19/03/ · In this Forex trading lesson, I am going to share with you three of my favorite price action trading strategies; pin bars, inside bars and false. These trading setups are simple yet very powerful, and if you learn to trade them with discipline and patience you will have a very potent Forex trading edge 29/07/ · There are a handful of price action setups out there, such as trading the inside bar (IB), bearish outside bar (BEOB), bullish outside bar (BUOB), double high lower close (DBHLC), and double low higher close (DBLHC). However, pin bars (PB) are the most discussed one, because these yield the best results. Example of a Bullish Pin Bar 03/04/ · The inside bar pin bar combination is no exception. Below are three things that must be present in order for this pattern to be considered tradable. These are in addition to the actual inside bar and pin bar, which are of course mandatory. 1) Time Frame. First and foremost, the pattern must form on the daily time frame. This is because the inside bar, which makes up half the pattern, is only valid Estimated Reading Time: 9 mins

No comments:

Post a Comment