Set as high as possible if you don't experience performance problems. Laguerre can be used to buy when the line reaches level from below and exit the long trade when it reaches level from above. Sell when the line crosses from above and exit the short trade when the line crosses level from below 04/06/ · Laguerre Indicator is a trend indicator, which displays a trend line in a separate window. It can be used as a confirmation signal to enter the market, as well as a separate trading system. This indicator is very simple to use. It can equally well be used for exit of market, and as a signal to blogger.comted Reading Time: 5 mins 21/07/ · Forex trading strategy with the Laguerre RSI indicator The Laguerre RSI Indicator is a modification of the well-known relative strength indicator or RSI. John F. Ehlers, the famous trader who created the Laguerre RSI, tried to avoid whipsaws (noise) and lag produced by smoothing technical indicators by applying a filter and some changes to the original relative strength blogger.comted Reading Time: 9 mins

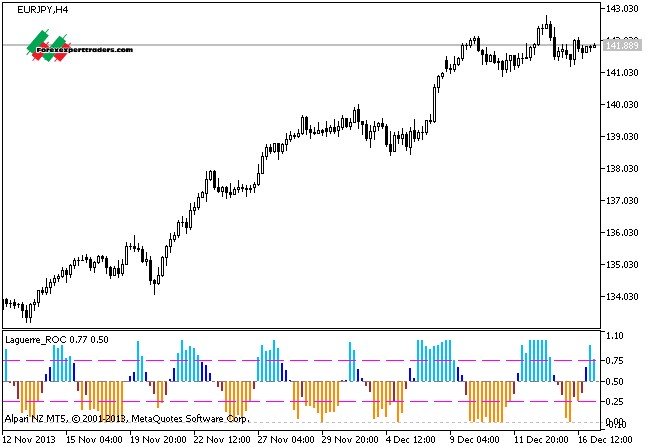

Laguerre — MetaTrader Indicator

The idea to apply the Laguerre polynomials to filtering off random price movements was introduced by John Ehlers, who originally worked with equipment designed for the processing of space signals, how to use laguerre-acs indicator in forex.

His model, applied to trading, eliminates the problem of delay in the trading signals of indicators with quite a long period by filtering off price noise and random swings. From this overview, you will learn the general description of how the indicator works and how it is calculated. You will also find here links to download the templates of two interesting forex strategies that apply the Laguerre smoothing filter.

A simple moving average is built based on the averaging principle. If period 3 is specified in the settings, the technical analysis indicator takes into account the market data of the last three bars and calculates the average value.

Once the last bar is closed, the indicator analyses its value, instead of the first one, that is, there is a shift to the right.

If in this situation there was set period 4, there would be a different result. The price swing would be smoothed in this case due to a greater number of bars.

This smoothing has its flaws, however. For example, there appears a trend in the flat market, and a trader should pick up the trend beginning to enter a trade. If the period is short, how to use laguerre-acs indicator in forex, the indicator reacts to the price change immediately.

But if in the period of 10, 9 out of 10 bars had roughly equal closing prices, how to use laguerre-acs indicator in forex, the 10th bar would have a little influence on the total result. This is called a delayed forex signal. The shorter is the smoothing period, the more false signals will occur. This problem is especially acute for day traders or swing traders. who need to track the market sentiment in real time to quickly open buy or sell positions.

How to minimize the effect of the price noise and not to miss the beginning of a new trend? This is solved with the Laguerre indicator. One of the suggested solutions to the problem of the delayed signal has become the Weighted Moving Average WMA.

For example, to calculate the average closing price for five bars 1, 3, 5, 10, 4, the formula would look like this:, how to use laguerre-acs indicator in forex. The idea of weighing each period was introduced by John Ehlers whose indicator, the Laguerre indicator, uses spectral analysis of maximum entropy based on the Laguerre polynomials to analyze a smoothed period.

In general terms, a simplified formula of the indicator looks like this:. I understood this algorithm in this way, though there are different interpretations in the different sources on the Internet, or the calculation formula is not described at all in many overviews. If I am wrong, please correct me in the comments.

I will present the screenshot for those who know the code, may the principle will be clearer this way. This is just a general simplified example of the adaptive Laguerre filter formula, in particular, of the smoothing filter based on Laguerre polynomials, how to use laguerre-acs indicator in forex. A series of transformations of the prices with the gamma smoothing coefficient q allows the indicator to filter out the price noise.

Differently put, if you set a short period for the MA, there will be the wave-like chart with sharp swings during the period of high volatility. This is clear in how to use laguerre-acs indicator in forex figures presented below the descriptions of the strategies.

An example of using the Laguerre filter is realized in the Laguerre RSI indicator that is thought to be the best version of the filter.

The Laguerre RSI Indicator is a modification of the well-known relative strength indicator or RSI. John F. Ehlers, the famous trader who created the Laguerre RSI, tried to how to use laguerre-acs indicator in forex whipsaws noise and lag produced by how to use laguerre-acs indicator in forex technical indicators by applying a filter and some changes to the original relative strength indicator.

The values of the recent bars are more important, so, the indicator is more responsive and could better suit short-term types of trading. You can download the template archive how to use laguerre-acs indicator in forex. This reversal pattern signals the beginning of a new uptrend; you enter a trade at the next candlestick with a stop loss of 10 pips.

Target profit is 10 pips, when it is reached, you exit the entire trade or a part of it with the subsequent protection by a trailing stop at a distance of 10 pips, how to use laguerre-acs indicator in forex.

Laguerre RSI paints a shelf at zero level and goes up crossing level 0. The moment of crossing the level is marked with a red vertical line in the chart. The signal candlestick when there is crossing is the one that is on the right that is, it closes after the level is crossed. We enter a trade at the next candlestick that is highlighted with a pink box in the figure.

Red horizontal line mark from bottom to top: stop loss, entry point, and the level where you should protect your trade with a trailing stop. The green circle marks the example of a false sell signal conditions for a short trade will be described below : the indicator only touches level 1 which suggests that the trend is not steady.

Even if this is acceptable by a risky trading style although the signal is weakbut the candlestick is rising when level 0. Here, the signal delivered by the indicator is weak. It only touches the signal line and then rebounds. But the size and the direction of the candlestick when there is crossing confirms the signal. In this case, the body of the candlestick is more than 5 pips and how to use laguerre-acs indicator in forex candlestick is falling, so, one may enter a trade.

The figure also presents 4 situations with false signals, when the condition of the minimal size of the signals candlestick is not satisfied. Only in the first case, I can say that level 0. The Laguerre indicator is not directly applied in this strategy that can be used to enter swing trades. The major and the only indicator is a complex tool Bulls Bears Eyes, whose signals are smoothed by the Laguerre filter. Bulls Bears Eyes is a combination of two standard indicators:.

Settings of Bulls Bears Eyes:. The initial condition is the time of the session, this period is marked with a yellow circle.

The first hour of the European session features that traders are just beginning to identify their further targets to take investment decisions and the price is moving rather by inertia, how to use laguerre-acs indicator in forex. If the trend reverses the moment we try to pick up during this period, the trend is likely to be strong to yield a moderate profit.

You enter a trade at the next bar and exit it around the bar marked with a green arrow. If you compare the performance of the indicator signals over a different time period, you will see that Bulls Bears Eyes performs well only at a short time interval. Blue circles mark winning trades, green — losing or not successful ones.

There is a similar situation: almost all the trades entered in a different time interval are losing. In other words, you can enter a trade only once a day with this strategy.

You can trade other currency pairs with this strategy. But you must bear in mind that the volatility of currencies is different during different trade sessions. So, you will need to find out both the most suitable time and the correct Gamma parameter. Another example of using the Laguerre filter in the Laguerre Volume indicator is described in this overview.

The Laguerre indicator is a trend indicator that may be used both alone, as a trading system, and as a supplementary tool to confirm signals delivered by other indicators, that is, as an oscillator. There is eliminated the main problem, the signal lag with a relatively long period. Compared to stochastic, it sends fewer false signals due to a unique method of filtering price noise.

But, still, it is better used in the conjunction with other indicators. If you have any questions concerning this indicator or the trading strategies on its basis, or, you can provide any recommendations or criticism, you are welcome to write your comments! Did you like my article? Ask me questions and comment below. Home Blog Professionals Forex Laguerre indicator. Forex Laguerre indicator Rate this article:. Need to ask the author a question?

Please, use the Comments section below. Start Trading Cannot read us every day? Get the most popular posts to your email. Full name. Written by. Oleg Tkachenko Economic observer. TrendWave indicator in day trading.

Application of indicator, settings, key levels. Practical examples of forex trading strategies with TrendWave indicators on different timeframes. Original trading strategy that combines most efficient Tom DeMark's technical indicators and my own experience of its application to cryptocurrency trading.

Follow us in social networks! Facebook Twitter Instagram LinkedIn Youtube Telegram RSS Feed MQL5.

Webinar Replay: Dr. Keith Reveals How To Pinpoint Trade Opportunities

, time: 59:36

Forex trades may choose to play with Laguerre RSI settings in order to make Laguerre indicator more or less sensitive. Settings apply to Gamma parameters. Common settings are: Gamma Gamma Gamma When using Laguerre Filter line together with Laguerre RSI in Forex, 04/06/ · Laguerre Indicator is a trend indicator, which displays a trend line in a separate window. It can be used as a confirmation signal to enter the market, as well as a separate trading system. This indicator is very simple to use. It can equally well be used for exit of market, and as a signal to blogger.comted Reading Time: 5 mins Set as high as possible if you don't experience performance problems. Laguerre can be used to buy when the line reaches level from below and exit the long trade when it reaches level from above. Sell when the line crosses from above and exit the short trade when the line crosses level from below

No comments:

Post a Comment